Ramsey County Property Tax Rates . access tax calculators and rate information to assist you with your property tax payments. Visit property tax and value lookup; property tax & value lookup. pay your property taxes online. the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. the assessor’s report details changes and trends in assessed property values in ramsey county based on type and. the total assessed estimated market value of ramsey county property for 2021, taxes payable 2022, is $62.23 billion, up from. Paying your property taxes is still provided through us bank. ramsey county (1.24%) has a 18.1% higher property tax rate than the average of minnesota (1.05%). To access the payment portal: Property tax payment due dates and late.

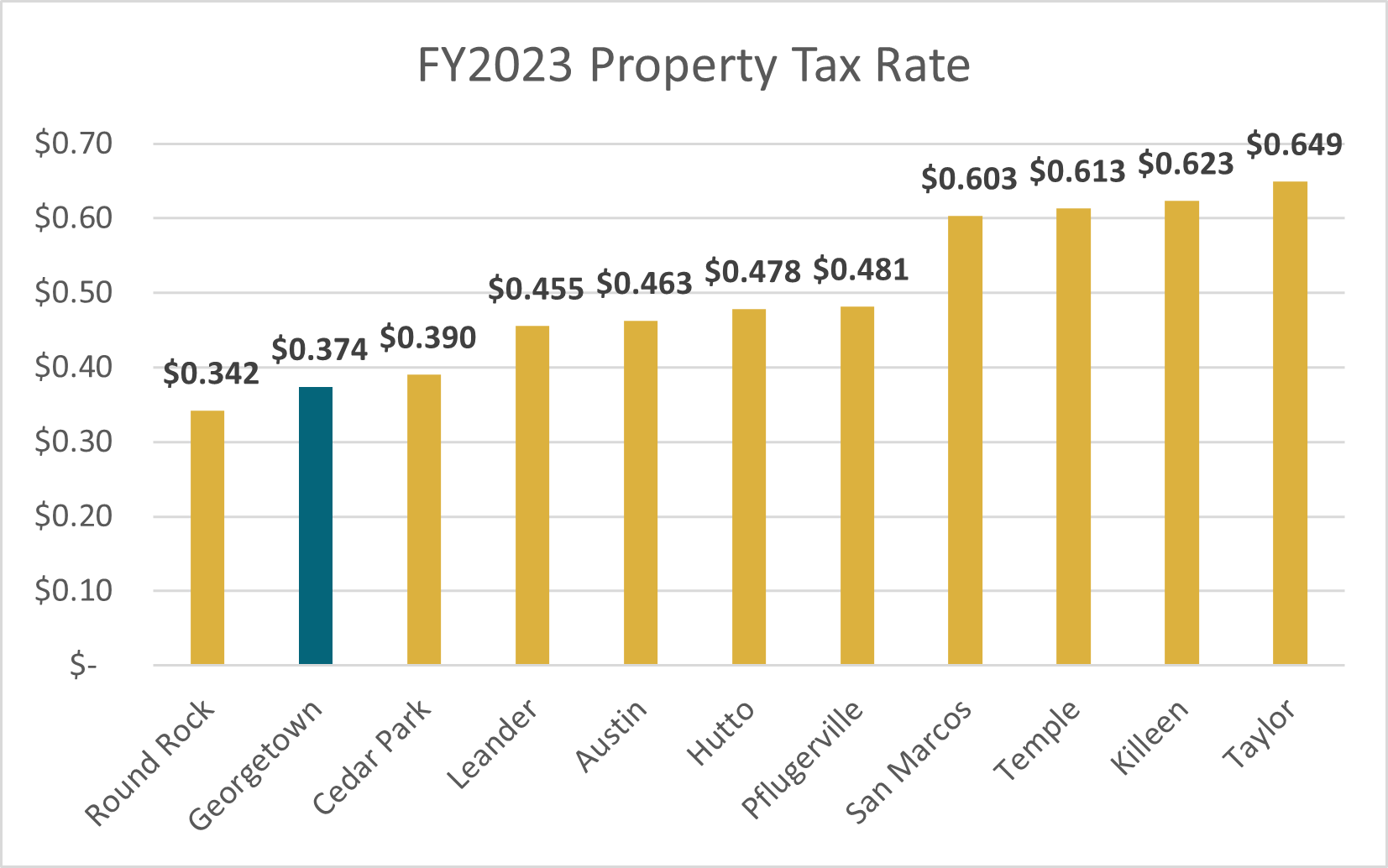

from finance.georgetown.org

pay your property taxes online. property tax & value lookup. Visit property tax and value lookup; the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. Paying your property taxes is still provided through us bank. access tax calculators and rate information to assist you with your property tax payments. the total assessed estimated market value of ramsey county property for 2021, taxes payable 2022, is $62.23 billion, up from. the assessor’s report details changes and trends in assessed property values in ramsey county based on type and. To access the payment portal: Property tax payment due dates and late.

Property Taxes Finance Department

Ramsey County Property Tax Rates access tax calculators and rate information to assist you with your property tax payments. pay your property taxes online. To access the payment portal: the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. Property tax payment due dates and late. Paying your property taxes is still provided through us bank. the total assessed estimated market value of ramsey county property for 2021, taxes payable 2022, is $62.23 billion, up from. Visit property tax and value lookup; ramsey county (1.24%) has a 18.1% higher property tax rate than the average of minnesota (1.05%). access tax calculators and rate information to assist you with your property tax payments. the assessor’s report details changes and trends in assessed property values in ramsey county based on type and. property tax & value lookup.

From finance.georgetown.org

Property Taxes Finance Department Ramsey County Property Tax Rates Property tax payment due dates and late. Visit property tax and value lookup; the total assessed estimated market value of ramsey county property for 2021, taxes payable 2022, is $62.23 billion, up from. pay your property taxes online. property tax & value lookup. Paying your property taxes is still provided through us bank. the median property. Ramsey County Property Tax Rates.

From taxfoundation.org

How High Are Property Tax Collections Where You Live? Tax Foundation Ramsey County Property Tax Rates property tax & value lookup. Paying your property taxes is still provided through us bank. access tax calculators and rate information to assist you with your property tax payments. Visit property tax and value lookup; the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home. Ramsey County Property Tax Rates.

From www.krislindahl.com

Ramsey County Property Taxes St. Paul Suburbs With Low Rates Ramsey County Property Tax Rates access tax calculators and rate information to assist you with your property tax payments. Paying your property taxes is still provided through us bank. the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. To access the payment portal: Property tax payment due dates and. Ramsey County Property Tax Rates.

From propertytaxgov.com

Property Tax Ramsey 2023 Ramsey County Property Tax Rates ramsey county (1.24%) has a 18.1% higher property tax rate than the average of minnesota (1.05%). property tax & value lookup. Property tax payment due dates and late. To access the payment portal: the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. . Ramsey County Property Tax Rates.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Ramsey County Property Tax Rates ramsey county (1.24%) has a 18.1% higher property tax rate than the average of minnesota (1.05%). Visit property tax and value lookup; Property tax payment due dates and late. To access the payment portal: the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. . Ramsey County Property Tax Rates.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Ramsey County Property Tax Rates the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. the total assessed estimated market value of ramsey county property for 2021, taxes payable 2022, is $62.23 billion, up from. ramsey county (1.24%) has a 18.1% higher property tax rate than the average of. Ramsey County Property Tax Rates.

From www.researchgate.net

County property tax rates within study area. Download Scientific Diagram Ramsey County Property Tax Rates To access the payment portal: the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. Paying your property taxes is still provided through us bank. Visit property tax and value lookup; the assessor’s report details changes and trends in assessed property values in ramsey county. Ramsey County Property Tax Rates.

From hxesxrjax.blob.core.windows.net

St Paul Property Tax Rate at Robert Lomax blog Ramsey County Property Tax Rates access tax calculators and rate information to assist you with your property tax payments. the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. Visit property tax and value lookup; Property tax payment due dates and late. pay your property taxes online. To access. Ramsey County Property Tax Rates.

From businessyab.com

Ramsey County Property Tax, Records and Elections Services 90 Plato Blvd W, St Paul, MN 55107 Ramsey County Property Tax Rates ramsey county (1.24%) has a 18.1% higher property tax rate than the average of minnesota (1.05%). access tax calculators and rate information to assist you with your property tax payments. the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. Visit property tax and. Ramsey County Property Tax Rates.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Ramsey County Property Tax Rates Paying your property taxes is still provided through us bank. pay your property taxes online. Property tax payment due dates and late. access tax calculators and rate information to assist you with your property tax payments. Visit property tax and value lookup; the median property tax (also known as real estate tax) in ramsey county is $2,345.00. Ramsey County Property Tax Rates.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Ramsey County Property Tax Rates pay your property taxes online. ramsey county (1.24%) has a 18.1% higher property tax rate than the average of minnesota (1.05%). Property tax payment due dates and late. the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. To access the payment portal: Visit. Ramsey County Property Tax Rates.

From www.countyforms.com

Ramsey County Property Tax Refund Form Ramsey County Property Tax Rates Visit property tax and value lookup; ramsey county (1.24%) has a 18.1% higher property tax rate than the average of minnesota (1.05%). access tax calculators and rate information to assist you with your property tax payments. the total assessed estimated market value of ramsey county property for 2021, taxes payable 2022, is $62.23 billion, up from. . Ramsey County Property Tax Rates.

From lorettewmidge.pages.dev

Ramsey County Property Tax Statement 2024 Carey Correna Ramsey County Property Tax Rates pay your property taxes online. Paying your property taxes is still provided through us bank. Visit property tax and value lookup; the assessor’s report details changes and trends in assessed property values in ramsey county based on type and. the total assessed estimated market value of ramsey county property for 2021, taxes payable 2022, is $62.23 billion,. Ramsey County Property Tax Rates.

From propertytaxgov.com

Property Tax Ramsey 2023 Ramsey County Property Tax Rates ramsey county (1.24%) has a 18.1% higher property tax rate than the average of minnesota (1.05%). property tax & value lookup. the assessor’s report details changes and trends in assessed property values in ramsey county based on type and. the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year,. Ramsey County Property Tax Rates.

From www.ohiocashbuyers.com

Why Do We Pay Property Taxes? Ohio Cash Buyers Ramsey County Property Tax Rates Property tax payment due dates and late. the assessor’s report details changes and trends in assessed property values in ramsey county based on type and. pay your property taxes online. the median property tax (also known as real estate tax) in ramsey county is $2,345.00 per year, based on a median home value. property tax &. Ramsey County Property Tax Rates.

From www.luxuryrealestatemaui.com

Maui Property Taxes Fiscal Year 2023 Tax Rates Ramsey County Property Tax Rates the assessor’s report details changes and trends in assessed property values in ramsey county based on type and. access tax calculators and rate information to assist you with your property tax payments. ramsey county (1.24%) has a 18.1% higher property tax rate than the average of minnesota (1.05%). property tax & value lookup. Property tax payment. Ramsey County Property Tax Rates.

From www.ramseysolutions.com

A Guide to Florida Taxes Ramsey Ramsey County Property Tax Rates the total assessed estimated market value of ramsey county property for 2021, taxes payable 2022, is $62.23 billion, up from. Visit property tax and value lookup; pay your property taxes online. Property tax payment due dates and late. ramsey county (1.24%) has a 18.1% higher property tax rate than the average of minnesota (1.05%). access tax. Ramsey County Property Tax Rates.

From www.krislindahl.com

Ramsey County Property Taxes St. Paul Suburbs With Low Rates Ramsey County Property Tax Rates the total assessed estimated market value of ramsey county property for 2021, taxes payable 2022, is $62.23 billion, up from. Paying your property taxes is still provided through us bank. Visit property tax and value lookup; access tax calculators and rate information to assist you with your property tax payments. Property tax payment due dates and late. To. Ramsey County Property Tax Rates.